How Software Companies Can Win in FY26 with AI Agents, Microsoft Marketplace, and Co-Sell

FY26 is not just another fiscal year for software companies; it marks a structural shift in how modern software is built, sold, and scaled. Traditional SaaS models are evolving rapidly, and customers are no longer impressed by incremental feature updates alone. What they expect now are intelligent, adaptive, and outcome-driven solutions that actively assist users in real time.

This is where AI agents come in.

Microsoft has made it clear through its FY26 strategy that AI agents, Microsoft Marketplace, co-sell alignment, and certified software designations are no longer optional growth levers. Together, they form a connected go-to-market engine that allows software companies to move faster, sell bigger deals, and reach enterprise customers globally.

This guide is written for:

- ISVs and SaaS founders

- Product and engineering leaders

- GTM and sales leaders

- Partner and alliance managers

If you are building software and want to turn AI innovation into predictable revenue, this guide will walk you through the whole journey from building AI agents to monetizing them, publishing on Microsoft Marketplace, scaling via co-sell and channels, and maximizing FY26 incentives and certifications.

Table of Contents

- The AI Agent Opportunity for Software Companies

- Choosing the Right AI Agent Build Strategy

- Designing AI Agents That Scale

- Cost Optimization and Model Selection

- Monetization Strategies for AI Agents

- Packaging and Publishing on Microsoft Marketplace

- Technical and Business Readiness

- Compliance, Validation, and Certification

- Scaling with Microsoft Co-Sell

- Expanding Through Channels and Distributors

- Maximizing FY26 Microsoft Incentives

- Certified Software Designations Explained

- Building a Sustainable Microsoft-Aligned Growth Motion

- Key Takeaways

Understanding the AI Agent Opportunity for Software Companies

AI agents mark a fundamental transition from passive software to active software.

Traditional applications wait for users to click, configure, and execute tasks. AI agents, on the other hand, understand intent and operate continuously in the background. They can pull data from multiple systems, make decisions within defined guardrails, and execute workflows without constant human input.

For software companies, this is more than a technical upgrade. AI agents become core value drivers. They increase customer stickiness by embedding intelligence directly into daily workflows. They also unlock premium pricing because customers are paying for outcomes, not just access to features.

Across industries, AI agents are already being adopted for intelligent copilots, operational automation, analytics, security monitoring, and vertical-specific use cases in finance, healthcare, retail, manufacturing, and compliance-heavy environments.

What makes this moment different is buyer maturity. Enterprises are no longer experimenting with AI; they are actively procuring ready-to-deploy, compliant, and scalable AI solutions. That expectation naturally favors software built on trusted platforms like Microsoft.

Common AI agent use cases include

- Intelligent copilots embedded into SaaS platforms

- Automated customer support and operations agents

- Data analysis and reporting agents

- Industry-specific agents for finance, healthcare, retail, manufacturing, and security

What makes this moment unique is that enterprises are actively looking for ready-to-use AI agents, not experimental tools. They want solutions that are secure, compliant, scalable, and backed by trusted platforms. This is where Microsoft becomes central.

Choosing the Right AI Agent Build Strategy

Before writing a single line of code, software companies must answer a critical question:

Do we transform what we already have, or build something entirely new?

Path 1: Agentifying Existing Applications

For many software companies, the fastest path forward is to embed AI agents into their existing SaaS platforms. This approach allows teams to improve user experience without rebuilding the entire product.

Agentifying an existing application works well because customers already understand the product and trust it. Adding AI agents enhances workflows, automates repetitive tasks, and delivers immediate value without forcing users to adopt a new system. From a business perspective, this path reduces risk, shortens time to market, and creates natural upsell opportunities.

This strategy is especially effective for mature SaaS products with an established customer base.

Path 2: Building Net-New AI Agents

In contrast, some companies choose to build standalone AI agents from the ground up. This approach requires more investment but offers greater differentiation. Net-new AI agents allow software companies to target new markets, address industry-specific problems, and position themselves as AI-first vendors.

While the GTM effort is higher, the long-term upside can be significant, especially in regulated or vertical markets where tailored AI solutions outperform generic platforms.

In practice, many successful ISVs start by agentifying their core product and later expand into standalone agents as their AI maturity grows.

The right choice depends on

- Customer maturity

- Product roadmap

- GTM readiness

- Investment capacity

Many successful companies eventually pursue both paths.

Designing AI Agents That Are Scalable and Profitable

One of the most common mistakes software companies make is focusing solely on what an AI agent can do, rather than how it will scale and sustain profitability.

A scalable AI agent starts with clarity of purpose. Teams must clearly define the problem being solved, the users who benefit most, and why the agent is meaningfully better than existing alternatives. Without this clarity, AI agents often become generic features that struggle to drive adoption.

From an architectural perspective, scalability depends on secure identity management, modular design, and support for multi-tenant environments. Enterprise customers expect AI agents to integrate seamlessly with their existing systems while maintaining strong security and isolation.

Microsoft’s cloud ecosystem provides these building blocks, allowing software companies to focus on differentiation instead of infrastructure complexity.

Defining the Agent’s Value

Ask:

- What specific problem does the agent solve?

- Who benefits from it?

- Why is it better than existing alternatives?

Clear answers help you avoid building generic AI that struggles to find adoption.

Architecture Considerations

Scalable AI agents require:

- Secure identity and access management

- Modular architecture

- Support for multi-tenant environments

- Integration with enterprise systems

Microsoft’s cloud ecosystem provides the foundation to build agents that meet enterprise expectations without reinventing the wheel.

Cost Optimization and Model Selection

AI introduces a new cost structure that many software companies underestimate early on. Model inference, throughput, storage, and infrastructure scaling all contribute to ongoing operational expenses.

The key to sustainable AI is intentional cost design. Not every use case requires the most advanced or expensive model. In many scenarios, slightly less powerful models deliver acceptable results at a fraction of the cost.

Successful companies design for experimentation first, then optimize once usage patterns are clear. Consumption-based models work well during early adoption, while reserved or provisioned capacity becomes more efficient as demand stabilizes.

Cost discipline ensures that AI agents remain profitable as customer adoption grows.

Choosing the Right Model

Not every use case needs the most advanced or expensive model. The goal is to balance:

- Accuracy

- Performance

- Cost

- User experience

Planning for scale is critical. Many companies start with flexible consumption-based models and move to reserved or provisioned capacity once usage patterns stabilize.

Smart cost design ensures your AI agent remains profitable as adoption grows.

Monetization Strategies for AI Agents

Monetization is where AI innovation becomes a real business.

AI agents support multiple pricing models, but the best approach always aligns pricing with customer value. Subscription-based models offer predictability, while usage-based pricing ensures customers pay in proportion to the value they receive. Seat-based pricing remains familiar to enterprise buyers, and outcome-based models can unlock premium margins when value is clearly measurable.

Many ISVs combine these approaches, offering a base subscription with usage-based or outcome-driven components layered on top. This hybrid approach balances revenue stability with scalability.

The goal is not just to charge for AI but to price it in a way that reflects tangible business outcomes.

Packaging and Publishing on Microsoft Marketplace

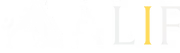

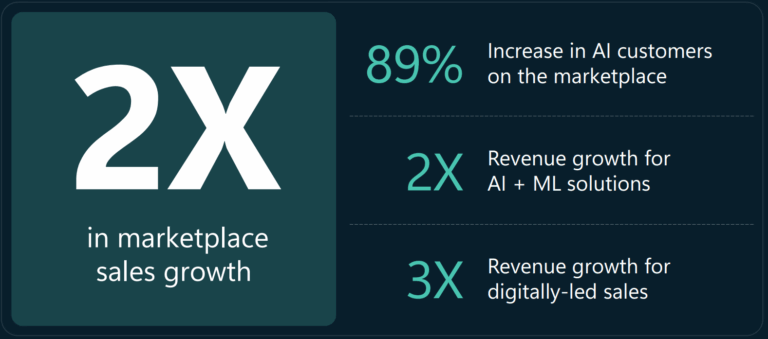

Microsoft Marketplace has evolved into a full-fledged global commerce platform. It simplifies procurement, accelerates deployments, and removes many of the barriers that slow down enterprise buying decisions.

Publishing an AI agent on the Marketplace allows customers to purchase using existing cloud commitments, which significantly reduces budget friction. It also enables private offers, multi-year contracts, and enterprise-grade deal structures.

Choosing between SaaS offers and Azure Container offers depends on how your solution is deployed and managed. Both models support AI agents, and the right choice can influence deal size, customer trust, and operational complexity.

Marketplace success depends on thoughtful packaging, not just listing availability.

Choosing the Right Offer Type

- SaaS Offers: Best for application-centric solutions

- Azure Container Offers: Ideal for infrastructure-heavy or customer-hosted deployments

Public vs Private Offers

- Public offers increase visibility

- Private offers enable custom pricing, multi-year deals, and enterprise negotiations

Strategic packaging directly impacts deal size and sales velocity.

Technical and Business Readiness for Marketplace Success

Marketplace publishing is as much a business motion as it is a technical one.

On the technical side, software companies must support secure authentication, automated provisioning, lifecycle management, and robust monitoring. Clear documentation and predictable deployment experiences are essential.

From a business standpoint, readiness includes defined support models, SLAs, sales enablement content, and legal documentation. Enterprises expect vendors to operate at scale from day one.

Companies that treat the Marketplace as a strategic channel, not a side experiment, consistently outperform those that don’t.

Technical Readiness Includes

- Secure authentication and identity integration

- Automated provisioning and lifecycle management

- Deployment templates and documentation

- Monitoring and support capabilities

Business Readiness Includes

- Defined support processes and SLAs

- Clear GTM messaging

- Sales enablement materials

- Legal and compliance documentation

Marketplace rewards companies that treat publishing as a business motion, not a checkbox exercise.

Compliance, Validation, and Certification

Trust is non-negotiable in enterprise software.

Microsoft Marketplace enforces validation processes that ensure solutions meet baseline technical and security standards. Beyond that, customers often require additional compliance certifications such as SOC 2, ISO, GDPR, or industry-specific standards.

While compliance can feel burdensome, it directly impacts deal size and sales velocity. Certified, compliant solutions face fewer objections, close faster, and win larger contracts.

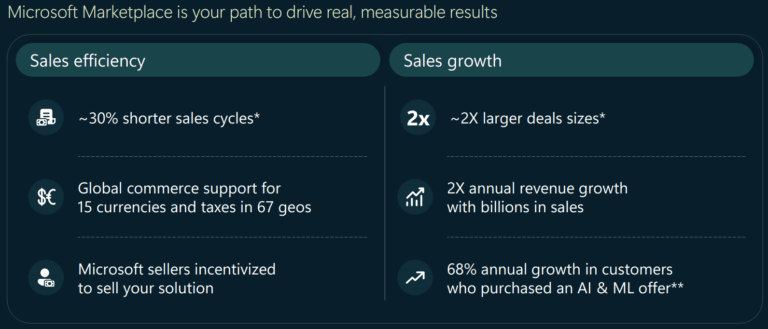

Scaling with Microsoft Co-Sell

Co-sell is one of the most powerful yet misunderstood growth levers for software companies.

When you align with Microsoft’s sales teams:

- You gain access to enterprise customers

- Your solution becomes part of larger deals

- Microsoft sellers are incentivized to sell with you

Azure IP Co-Sell

Becoming co-sell eligible allows customers to purchase your solution using existing Azure commitments, dramatically reducing friction and shortening sales cycles.

Maximizing FY26 Microsoft Incentives

FY26 offers substantial financial incentives for software companies aligned with AI and Marketplace priorities. Build & Publish incentives, Customer Migrate & Modernize funding, Marketplace Rewards, and Azure sponsorships can significantly offset development and GTM costs.

As Marketplace performance improves, ISVs unlock higher incentive tiers, expanded GTM support, and increased co-sell visibility. Incentives should be planned strategically, not treated as afterthoughts.

Key incentive areas include

- Build & Publish incentives

- Customer Migrate & Modernize incentives

- Marketplace Rewards

- Azure sponsorships

As your Marketplace performance grows, you unlock:

- Higher incentive tiers

- More GTM support

- Greater co-sell visibility

Smart incentive planning can significantly reduce your cost of growth.

Certified Software Designations: A Growth Multiplier

Certified Software Designations validate solution quality, interoperability, and customer success. For buyers, they signal trust. For Microsoft sellers, they signal readiness. For ISVs, they unlock better visibility, higher incentive tiers, and enhanced GTM assets.

Certification is not just a badge; it is a growth accelerator that compounds over time.

Building a Sustainable Microsoft-Aligned Growth Motion

Long-term success in FY26 requires alignment across product, GTM, and partnerships. Software companies that win treat AI agents as core capabilities, Marketplace as a primary channel, and co-sell as a strategic investment.

This alignment creates predictable growth backed by Microsoft’s global ecosystem.

Key Takeaways

- AI agents are becoming the new standard for modern software

- Microsoft Marketplace is a primary GTM channel, not an add-on

- Monetization and cost design are as important as AI capability

- Co-sell unlocks enterprise scale and committed cloud budgets

- FY26 incentives and certifications can dramatically accelerate growth

- Alignment with Microsoft’s strategy creates long-term competitive advantage

Frequently Asked Questions (FAQs)

What is an AI agent, and how is it different from a traditional SaaS feature?

An AI agent is an intelligent component that can understand user intent, take actions across systems, and operate with a level of autonomy. Unlike traditional SaaS features that require users to follow predefined workflows, AI agents actively assist users by automating tasks, making decisions, and learning from context. This shift turns software from being tool-driven to outcome-driven.

Do software companies need to build AI agents from scratch?

No. Software companies can either agentify their existing applications or build new AI agents. Many organizations start by embedding agents into their current SaaS products to deliver quick value, then later expand into standalone or industry-specific AI agents as part of their growth strategy.

How do AI agents help software companies grow revenue?

AI agents increase revenue by improving product differentiation, enabling premium pricing, increasing customer stickiness, and expanding use cases. When combined with Microsoft Marketplace and co-sell, AI agents also help software companies access enterprise customers, larger deal sizes, and faster sales cycles.

What is the Microsoft Marketplace, and why is it important for ISVs?

Microsoft Marketplace is a global digital storefront where customers discover, purchase, and deploy cloud and AI solutions. For ISVs, it simplifies procurement, enables customers to use existing cloud budgets, supports private and multi-year deals, and unlocks co-sell and incentive opportunities that are difficult to achieve through direct sales alone.

Should I publish my AI solution as a SaaS offer or an Azure Container offer?

The choice depends on your deployment model.

- SaaS offers are best when your solution is hosted and managed by you.

- Azure Container offers work well when customers deploy the solution into their own Azure environment.

- Both models are supported for AI agents, and many enterprise-focused ISVs use container offers for greater control and compliance.

How do software companies monetize AI agents effectively?

AI agents can be monetized using subscription-based pricing, usage-based pricing, seat-based licensing, or outcome-based models. The most effective approach aligns pricing with customer value and the cost of delivering AI capabilities. Many successful ISVs combine multiple pricing models to balance predictability and scalability.

What is Azure IP co-sell, and why does it matter?

Azure IP co-sell allows software companies to sell their Marketplace-listed solutions alongside Microsoft sellers. When a solution is co-sell eligible, customers can purchase it using their Azure consumption commitments, which significantly reduces budget friction and helps close larger enterprise deals faster.

Can smaller software companies benefit from co-sell with Microsoft?

Yes. Co-sell is not limited to large ISVs. Smaller software companies that publish transactable Marketplace offers, build on Azure, and meet basic eligibility criteria can work with Microsoft sellers. Early alignment often helps smaller ISVs accelerate their pipeline and credibility.

What role do channel partners and distributors play in Marketplace sales?

Channel partners and distributors help software companies scale faster by reselling Marketplace solutions, creating private offers, and bundling software with services. This allows ISVs to reach new markets and customer segments without building large direct sales teams.

What incentives are available for software companies in FY26?

In FY26, Microsoft offers multiple incentives for software companies, including Build & Publish incentives, Customer Migrate & Modernize incentives, Marketplace Rewards, and Azure sponsorships. As Marketplace performance grows, ISVs unlock higher incentive tiers and additional go-to-market benefits.

What is a Certified Software Designation (CSD)?

A Certified Software Designation is a Microsoft recognition that validates a software solution’s quality, interoperability, and customer success. It signals trust to enterprise buyers and Microsoft sellers, helping ISVs stand out in the Marketplace and unlock enhanced co-sell, incentive, and marketing benefits.